UNDERSTANDING STRATA

Frequently Asked Questions

Frequently Asked Questions

The concept of strata title, where persons own and have title to individual lots within buildings or complexes, was originally devised in New South Wales in the early 1960’s. Before this time a title was held by a company or co-operative rather than an individual. Therefore essentially, a strata scheme is a building or group of buildings that have been divided into ‘lots’ which may be individual apartments, office, industrial, commercial or retail units, townhouses or retirement villages. When a person buys a lot, they also share ownership of common property with other lot owners. This may include shared gardens, external walls, roofs, driveways and stairwells. Lot owners are members of the owners’ corporation, which owns and manages the common property. An owner’s corporation is automatically created when a strata plan is registered. Where strata titles are used for a building or complex, the property is often referred to as a ‘strata scheme’.

In strata schemes:

- A strata scheme comprises strata lots and (usually) common property

- The common property is held and controlled by the Owners Corporation on behalf of all the lots owners

- The property owner may be an individual, family or company

- The land occupied by the owners is referred to as a strata lot

- They may be owned in fee simple or a tenant under a lease (leasehold)

- A scheme may involve occupation/ownership of more than one strata lot (e.g. units, town houses) in a building within the one parcel of land, as in the case of retirement villages, rural development concepts and other multiple dwelling developments

- Most schemes have shared common property, i.e. hallway, garden area, driveway, recreational area, farmed paddock, structural walls, floors and roofs.

- The strata lot does not have to adjoin or be near other strata lots within the same scheme, e.g. cabins, mobile home, caravan site, rural scheme

It is not required by law to engage the services of a Strata Management firm, however owners must be aware that the Owners Corporation is legally obligated to meet certain requirements to comply with the Strata Schemes Management Act 1996. The advantage of appointing a Strata Manager is that they are specialists in areas such as administration (eg. management of Strata Roll), compliance (eg. fire safety or OH&S), accounting (eg. issuing of levies, taxation, budgeting), insurance (eg. renewals and claims) and establishing preventative maintenance programs (eg. gutter cleaning, sump pit cleaning and pump servicing). Employing a Strata Manager will ensure that there is no bias towards any one party and that the best interests of the building is safeguarded. Strata One has a range of management options from an all-inclusive agreement with or without fixed disbursements through to our strata essentials package that suits smaller strata schemes wishing to take a more hands on approach with their daily management.

The Strata Manager carries out some or all of the functions, duties or powers of the Owners Corporation in administering and maintaining a strata scheme or community title. This role includes but is not limited to secretarial and administration, arranging insurance, organising maintenance works, maintaining financial records and bank accounts, advising on By-law and other legal matters. A Strata Manager in New South Wales must be licensed under the Property, Stock and Business Agents Act.

Insurance of the property is required to protect the structure of the building and items agreed upon by the Owners Corporation in the event of an accident or undue events that may occur. Insurance policies are reviewed at each annual general meeting and the policy varies depending on the needs of the Owners Corporation. Owner occupiers are recommended to obtain contents insurance to protect their personal belongings and investors are encouraged to obtain landlord insurance for those renting their unit.

On 19th October 2011, the NSW Parliament passed a package of reforms to the Home Building Act 1989 which includes changes to:

Home Warranty Insurance

Statutory Warranty

Contract requirements

These reforms apply to all residential building work covered by home warranty insurance but do not apply to claims that have already been made (whether finalised or not), or to legal proceedings underway or finalised.

The changes will commence in two stages, the first took effect on 25th October 2011, while second will begin on 1st February 2012.

For further information, please visit Fair Trading.

NSW Government completed an online Open Forum which closed 29th February 2012. This forum was established to give those involved or interested in the Strata Community an opportunity to provide input to the reform. These findings are available at: www.openforum.com.au/strata.

You must first contact your Strata Manager or Property Manager to determine what your Strata or Community Title Schemes position is in relation to pets. An Owners Corporation will specify within the By-Laws (option 16) its position in relation to the keeping of animals at the property, with one of the following options:

a) An owner may only keep an animal once permission is obtained from the Owners Corporation

b) An owner may keep certain animals such as cats, dogs, birds or fish under certain terms and conditions. Permission to keep other types of animals must be obtained from the Owners Corporation prior to keeping the animal

c) No animals may be kept at the Strata Scheme

If option a) applies, the applicant should write to the Owners Corporation through your Strata Managing Agent requesting approval to keep the specific animal. The request will then be reviewed and a written response will be minuted on file.

It should be noted that no Owners Corporation can prohibit the keeping of a guide dog used by a visually impaired person (section 49(4) Strata Schemes Management Act 1996)

In most instances the answer will be yes, you will need permission from the Owners Corporation or Executive Committee prior to undertaking an alteration or addition to your lot. Items such as installing an air-conditioner, skylights, pergola or awning need formal approval.

Most Strata Schemes are registered with a standard By-Law titled Damage to Common Property which is By-Law 5. This By-Law prevents an owner from damaging or defacing any structure that forms part of common property, unless prior written approval from the Owners Corporation is obtained.

The type of permission required will largely depend on the size and type of alteration to be made. If the alteration is relatively simple, permission may simply be granted by your Strata Manager or Executive Committee. More complicated matters may require a special By-Law to be passed by the Owners Corporation at a general meeting.

All requests for permission must be submitted to your Strata Manager in writing. If you are a tenant, the request must come from your Property Manager.

Your levies contribute to the daily operation and future capital expenditure of the strata or community scheme. Levy payments are divided into two key funds; administration fund for annual operating expenses and sinking fund for future capital expenses such as painting or roof replacement.

Levy contributions are reviewed yearly by the owners at the annual general meeting. The amount of levies is agreed by those attending the meeting and this determination is usually based on the budget provisions which have been established by your Strata Manager and then reviewed by the Executive Committee. You should always carefully review and understand these budget estimates prior to the meeting so you are aware what levies will be applied.

A Capital Works fund is designed to raise essential funds required for capital maintenance expenses such as the replacement of the roof or painting. The aim of the Capital Works fund is to accumulate monies over time to ensure sufficient reserves are available to accommodate future capital maintenance expenses.

The Owners Corporations must obtain a Capital Works fund forecast report which combined with the assistance of the Executive Committee will provide a basis in which levy funds are calculated and proactive maintenance is scheduled. A healthy Capital Works fund combined with a proactive approach to preventative maintenance alleviates any potential investor questions in relation to unknown risks such as a special levies being required.

Legal obligations relating to compliance vary from state to state. Essentially, an Owners Corporation has the obligation to ensure the property is safe and fit for purpose. Some areas of compliance are; maintenance of common property; recording of the Strata Roll; insurance, accounting and taxation requirements; servicing of essential items (eg. fire safety equipment, lifts and cooling towers). An Owners Corporation must be aware that items such as fire safety equipment, lifts and cooling towers need to have relevant certificates submitted to authorities on an annual basis. Fines apply to those who do not comply and more importantly failure to take preventative measures can risk people’s safety.

For further information on legal obligations, please contact Strata One for assistance.

By-Laws are a set of rules established to assist in harmonious communal living. These rules have been designed to provide boundaries on what can and cannot be done by residents. Each Strata Scheme establishes a list of relevant By-Laws for their building which is then registered on title. For buildings managed by Strata One, the By-Law list relating to your Strata Plan is located on the communal notice board or alternatively contact our office for a copy.

Strata plans are lodged in respect of a parcel of land to create individually owned lots and common property within a strata scheme. Strata plans often relate to multiple units within an apartment building, or several townhouses within a development.

Registration of a strata plan results in the creation of the strata scheme and issue of titles under the strata scheme legislation.

In order to determine whether an item is common property you must inspect a copy of the registered strata plan. The registered strata plan defines the lot boundaries and can clarify what areas are common property.

Strata title management refers to the management and administration of properties such as apartment buildings or townhouses whereby individual owners own their respective units or lots while also sharing ownership of common areas and facilities, such as stairwells, hallways, parking lots, and recreational spaces. The legal framework for strata title management is governed by the Strata Schemes Management Act.

Key aspects of strata title management include:

- Owners’ Corporation This is a body made up of all the individual unit owners. The owners’ corporation is typically responsible for making decisions related to the common property, such as maintenance, repairs, and improvements.

- Strata Manager: In many cases, the owners’ corporation hires a professional strata manager or management company to handle day-to-day administrative tasks. The strata manager may assist with financial management, organizing meetings, maintaining records, and ensuring compliance with relevant laws and regulations.

- By-laws: Strata schemes typically have by-laws that set out the rules and regulations governing the property. These may include rules about noise, pet ownership, use of common areas, and other matters that affect the community.

- Strata Levies/Fees: Owners are usually required to pay regular fees or levies to cover the costs of maintaining and managing the common property. These fees are used for services such as building maintenance, insurance, and administration.

- Meetings: An annual general meeting is held in which all of the key decision is relation to the building are made. Regular meetings are also held to discuss and decide on day to day matters affecting the strata scheme by the elected Strata Committee. At the Annual General Meeting decisions are made around budget approvals, changes to by-laws, proposed works, election of the strata committee and any other relevant matters.

The main governing legislation for strata management in New South Wales (NSW), Australia, is the “Strata Schemes Management Act 2015” (SSMA 2015). This legislation is a comprehensive legal framework that regulates the creation, management, and administration of strata schemes in NSW.

The Strata Schemes Management Act 2015 covers a wide range of topics related to strata living, including:

- Creation and registration of strata schemes: The process of establishing strata schemes and registering them with the appropriate authorities.

- Management and administration: Rights and responsibilities of owners, including the establishment of strata committees, by-laws, and decision-making processes.

- Common property: Regulations concerning the use, maintenance, and repair of common property within strata schemes.

- Levies and financial matters: Procedures for determining and collecting strata levies, budgeting, and financial management of strata schemes.

- Meetings and decision-making: Rules and requirements for holding general meetings, special resolutions, and decision-making processes within strata schemes.

- Dispute resolution: Mechanisms for resolving disputes between owners and addressing breaches of by-laws.

Renters and strata owner-occupiers (those who own the apartment they live in) can consider contents insurance for the items inside their apartments.

A contents insurance policy can cover many different belongings. This can include appliances such as fridges and washing machines, electronics such as televisions and stereos, furniture, musical instruments, computers, tools, plus other items. It can also cover fixtures such as carpets, floating floors, kitchen cupboards and other built-in furniture or appliances that the strata insurance does not cover. Further information detailing what types of belongings may be covered by a contents insurance policy can be found by reading the Product Disclosure Statement of the insurance product you might be considering.

As apartments share common spaces with neighbouring apartments such as the car park, stairwells, lifts, yards, etc., these areas along with the building are covered by strata insurance. Strata owner-occupiers and apartment owners pay strata levies that go towards the strata insurance.

When the apartment owner does not live in their apartment and rents it out to tenants, it is recommended that they get landlords insurance to cover the contents and fixtures of their rental property.

Dealing with a noisy neighbor can be challenging, but there are several steps you can take to address the issue:

- Talk to Your Neighbor: In some cases, the issue may be resolved amicably by discussing it with your neighbor. They may not be aware that their activities are causing a disturbance, and a polite conversation can sometimes lead to a resolution. Choose a calm and non-confrontational approach, expressing your concerns and asking if there is a way to minimize the noise.

- Keep a Record of the Noise: If the issue persists, start keeping a record of the dates, times, and nature of the noise disturbances. This documentation can be useful if you need to escalate the matter.

- Review Local Noise Regulations: Familiarize yourself with local noise regulations or by-laws. Most councils have specific rules regarding acceptable noise levels during certain hours. If your neighbor is violating these regulations, you can use this information when addressing the issue.

- Talk to Other Neighbors: If the noise is affecting multiple residents, consider discussing the matter with other neighbors. They may have similar concerns, and addressing the issue as a group can carry more weight.

- Submit a Complaint: If your attempts to resolve the issue directly with your neighbor are unsuccessful, and the noise is persistent and violating by-laws and/or council regulations, you may need to file a complaint. You can approach strata, the local police or the council depending on the nature of the issue. Provide them with the documentation you’ve gathered.

- Mediation Services: In some cases, mediation services may be required which would be facilitated via strata to find a mutually agreeable solution.

Remember to approach the situation calmly and responsibly, and try to find a resolution that respects the rights and needs of both parties. Communication is key, but if the issue persists, don’t hesitate to document this issue and take things further to gain a resolution

All owners contribute financially to the ongoing care and maintenance of their building. Invoices are issued quarterly and paid into a bank account managed by Strata One.

There are three types of strata fees that you can expect to pay:

- Administration fund levies – These fees cover the day-to-day management and expenses of the building such as cleaning, gardening, utilities such as electricity for common areas and building insurance premiums

- Capital works levies (previously known as a sinking fund) – This pays for more costly repairs and maintenance such as roof restoration, replacing fittings and fixtures, painting, updating outdoor furniture and any other major works.

- Special levies – These are only relevant when unexpected expenses arise and there aren’t enough funds available.

Strata One manages the strata levies for all of the buildings that are managed on behalf of the Owners Corporation.

Our Accounting team includes CA qualified Accountants that hold Strata Licences and have police checks to ensure that your funds are being managed in the most transparent and effective way.

The strata fees are agreed upon at the Annual General Meeting of all owners. While it may seem like a chore attending the Annual General Meeting, it is important to be involved and have a say in the future of your building. This is also the best forum to gain an understanding of the components that make up the budget which determines the strata fees. Whilst Strata One sets a proposed budget, the strata committee is engaged to provide feedback on the budget.

Whilst no-one likes the surprise of a significant increase in levies, it is really important to attend the Annual General Meeting to understand the reasons why. The levies can’t be put up on a whim by the Strata company. The levies are based on the budget which is approved by all owners at the AGM. There are multitude of factors that may contribute to the increase such as planned major works, upgrades, defect rectification or fire compliance requirements. It’s really best to not guess and get involved in the AGM.

The strata levies for every building will vary based on a multitude of factors such as the size, amenities or maintenance requirements of a property. An older complex may have a higher levy to cover ongoing repairs. A newer development can also attract high strata fees if it has amenities such as a gym, swimming pool or lifts to maintain.

How much is paid is also dependent on how well funds are managed. So, when inspecting an apartment or townhouse, always take the time to check out the common areas too. If the building shows signs of neglect, then there could be some surprise costs ahead.

Always do a strata inspection before purchasing, as this will reveal whether the building is in a sound financial position, any legal disputes between neighbours or upcoming major repairs.

No, the amount that the individual owners within the building pay is determined by the ‘unit entitlements’. The term ’unit entitlement’ refers to the amount assigned to individual units within a property based on its value in the strata scheme at registration. Units with a higher ‘unit entitlement’ will pay higher levies than units with a lower ‘unit entitlement’. Therefore, strata fee’s are likely to be higher for units with balconies, courtyards, storage cages or parking spaces in comparison to those without. Larger units will also have higher ‘units of entitlement.’

As a guide, expect to pay between 0.3 per cent to 1.2 per cent of a property’s value in strata fees. Those with more amenities will be in the upper end of this range.

Always do your homework on strata fees by looking at what is being charged by comparable buildings. Low levies can correlate with poor maintenance. This can not only be expensive to fix but can impact the long-term value of your property.

It is important to speak to someone from the strata committee or contact us if you are experiencing financial difficulties. In some circumstances a payment plan can be established if agreed to by the strata committee.

Legal action can be taken against unpaid strata fees and interests charged. It may be tempting to withhold a levy payment in protest if you are unhappy with the body corporate, however, this means that you lose the right to vote at meetings and have your say.

Strata levies are based on unit entitlement and don’t include Council rates. So don’t forget to factor these into your quarterly budget.

Investors can claim contributions made into the strata administrative or capital work funds as a tax deduction. Like any claim, documentation of expenses is essential. Costs which are deemed to be a ‘special purpose’, however, may not be deductible. Be sure to discuss this with your tax accountant.

The Strata One Process

Why poor Strata Management compromises your apartment’s growth

Too many Strata Committee members are unhappy with the living environment in their strata apartment. A lack of trust in the Strata Manager leads to stress, tension and feeling caught in the middle.

Six foundations for apartment growth certainty

Expectations are agreed between the owners and Strata One in relation to how we will work together. Areas include: how and how often we will communicate, how decisions will be reached, who will be responsible for what and developing a schedule for routine matters.

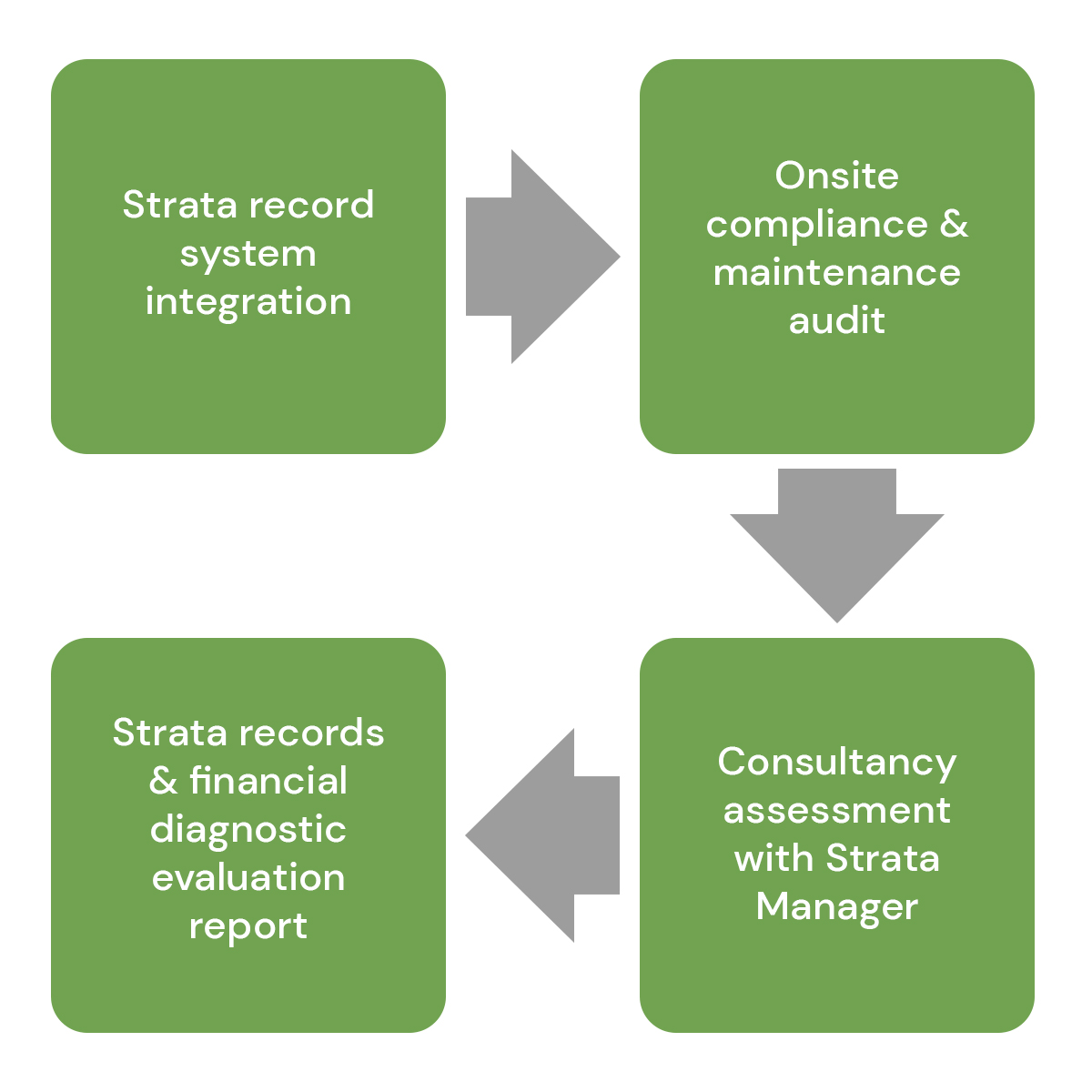

It’s easy to transition to the Strata One standard

Expectations are agreed between the owners and Strata One in relation to how we will work together. Areas include: how and how often we will communicate, how decisions will be reached, who will be responsible for what and developing a schedule for routine matters.

Relax, knowing that the financial growth of your strata apartment is in safe hands

Expectations are agreed between the owners and Strata One in relation to how we will work together. Areas include: how and how often we will communicate, how decisions will be reached, who will be responsible for what and developing a schedule for routine matters.

Be informed, have clarity and control over your strata building

Be informed, have clarity and control over your strata building